Exchange Platforms Analytics

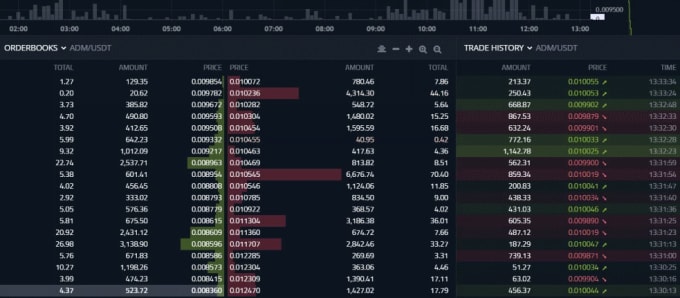

The Exchange Platforms market currently ranks #520 globally, operating as a niche segment with relatively low competition among 11 active sellers. The average service price is $1,100, with 16 different services available across the category. Historical data shows modest activity with 8 total orders completed. This market demonstrates stability but with limited current transaction volume. The low competition intensity score suggests room for new entrants to establish themselves, particularly those who can differentiate their offerings. While current revenue figures are modest, the presence of multiple active sellers indicates sustained business interest in this space. The fact that sellers maintain presence despite low volume suggests they may be positioning for future growth or serving specific client needs with higher-value transactions. Looking ahead, this category shows potential for development, especially given the stable trend and manageable competition levels. New sellers entering this space might find opportunities by focusing on specialized exchange services or by introducing innovative platform solutions. The relatively high average price point of $1,100 suggests customers are willing to invest in quality exchange platform services, though sellers should be prepared for potentially irregular sales patterns given the current transaction volumes.