Tax Exemptions Analytics

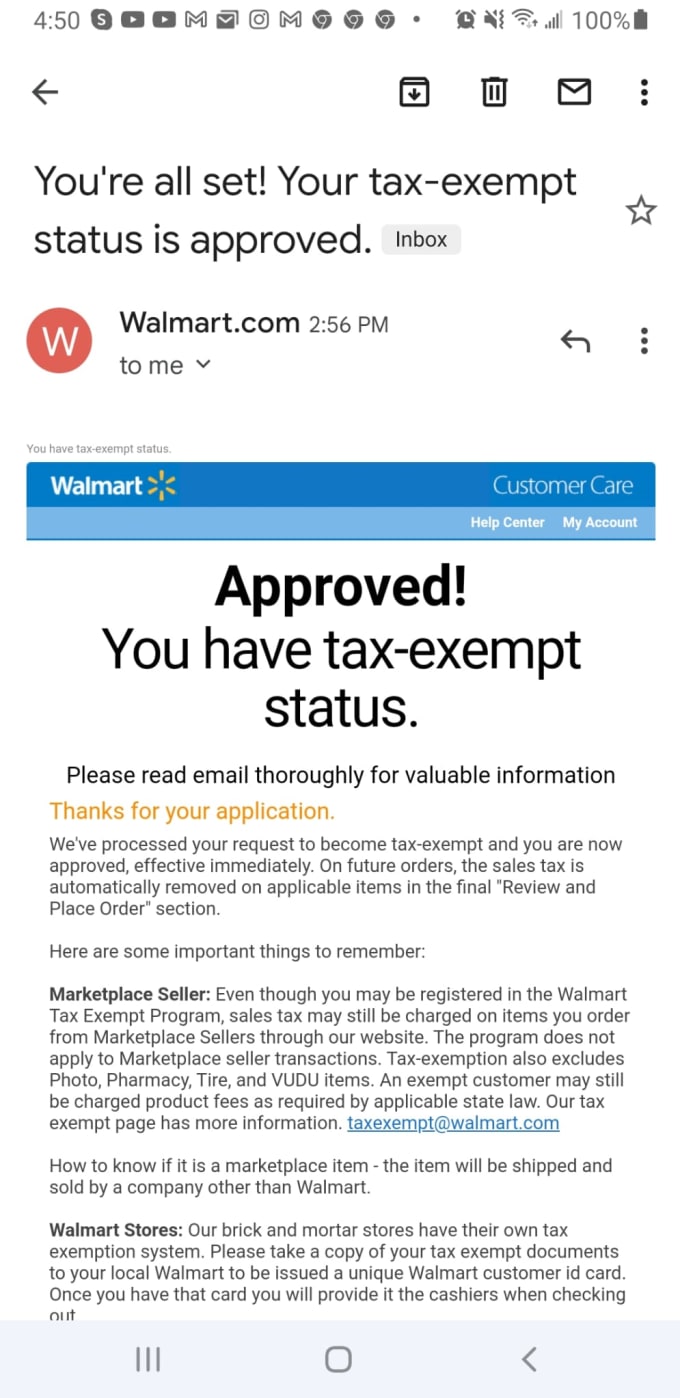

Tax Exemptions Market Summary The Tax Exemptions market currently generates average monthly revenue of $442 per seller, with services priced around $111. With 271 active sellers handling about 4 orders per month each, this represents a small but stable market segment with a +0.02% global market share. The total market has processed 3,220 historical orders, indicating established demand for these services. The market shows modest growth signals, with revenue increasing by +0.03% and sales volume growing at +0.12%. However, high competition levels (98.89 competition score) and a declining overall trend suggest this is a challenging space for new entrants. The wide revenue range from $45 to $1,170 per month indicates significant variation in seller success rates, with top performers capturing substantially more value than average. Looking ahead, the moderate growth rates and high competition suggest sellers should focus on specialization or premium service offerings to stand out in this crowded market. The best opportunities likely lie in identifying underserved niches or building strong reputation to capture higher-value clients.